Enron: The Smartest Guys in the Room

Now that a few years have passed between the bankruptcy of Enron and its related indictments, it's a good opportunity to look back for a "big picture" view of the entire debacle. Enron: The Smartest Guys in the Room, based on the book The Smartest Guys in the Room: The Amazing Rise and Scandalous Fall of Enron by Fortune reporters Bethany McLean and Peter Elkind does just that. Writer/director Alex Gibney takes a look at the entire scandal from start to finish, examining the characters involved, the situations that led to the bankruptcy, and various other affected issues. Gibney gives a good macro view of all the events, and manages to make everything pretty interesting, easily understandable, and gripping, despite the fact that most of what happened is common knowledge by know.

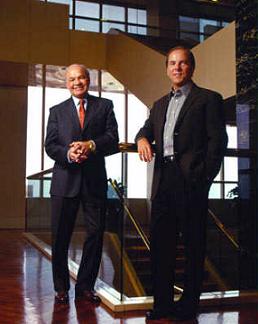

Gibney provides a wealth of background information, setting the viewer up for a good account of what went wrong and why. The overriding factor was greed and arrogance. The best way to make money for everybody was for the stock price to stay high. This meant that every quarter, Enron had to report good results so that analysts would keep them on their "buy" lists. The normal way to achieve this would be through good business practices. Enron, led by CEO Jeffrey Skilling, Kenneth Lay, and CFO Andrew Fastow, bent the accounting rules as far as they would go. They moved money around fake corporations and basically fabricated favorable results. They got nice and cozy with analysts, and as a result, the stock price stayed high.

Their downfall began when McLean wrote an article asking how Enron made money. They were an energy company that shot to prominence in a very short time. In the end, their goal was to play the energy markets like the stock market, buying and selling energy based on the market price. Enron took advantage of some very badly written deregulation laws in California, profiting generously off the energy crisis a few years ago that led to the ouster of Governor Gray Davis. And it was all for money. Gibney includes the now infamous recordings of traders gloating over poor old grandmothers.

When Enron crashed, it crashed hard. Thousands of people lost their pensions because all of the stocks in their 401(k) were in Enron stock. Meanwhile, the Lay's still lived like kings. Gibney interviews various insiders who offer their take on events, so viewers are able to get an inside look at a giant corporation crumbling. The events unfold chronologically, and with the benefit of hindsight, comments (er, lies) by Lay and Skilling make them look like absolute demons. Traders ran the company, and Skilling grew increasingly unhinged, until a freakout during a conference call. A few of the executives offer their insight into events, giving a heretofore unseen look at events from the insider view. The only distasteful element was Gibney's decision to recreate the suicide of J. Clifford Baxter, also one first cracks in the dam. Otherwise, it is a good recap of Enron's bankruptcy and a cautionary tale for analyst independence and portfolio diversification.